What do you do with your business profits?

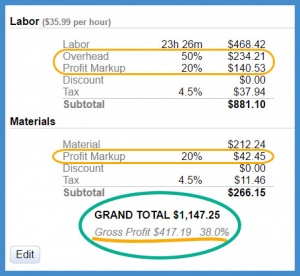

We’re talking profits today. If you’ve looked at the cost summary of a job in PEP this week, you may have noticed a new line for gross profit. Gross profit is everything that isn’t raw wages or materials. Some of that gross profit will go to pay business operating expenses (insurance, rent, loans, advertising, etc.). What’s left after paying those expenses is your net profit.

So what do you do with your business profits? Pay yourself? Go on vacation? Put the money back into the business? The list of what you can do with your business profits is endless. Here are 3 suggestions to consider:

3 Ways to Invest Business Profits

1. Savings. Cash flow can be an issue for seasonal businesses. Poor cash flow can lead to bad business decisions, like dropping your price to close a sale. Putting money into a savings account will ensure you have cash down the road when you need it.

2. Put profits back into the business. That could mean replacing tools, upgrading equipment or technology, buying another vehicle, or trying a new advertising campaign. Anything that will improve productivity or attract new quality leads is a worthwhile investment.

3. Invest in your employees. Spend some of the business profits on employee training; you’ll end up with more productive employees. Or consider giving your employees a raise. Raises validate the hard work they do and lead to happy, loyal employees. Clients will notice their competence and confidence (and that’s great for your company brand).

Recent Comments